It was a humid summer morning in Shanghai when I first stepped into a sprawling laser equipment factory. The rhythmic hum of fiber laser modules filled the air, technicians in clean blue overalls moved quickly between assembly stations, and forklifts carried stacks of neatly packaged machines ready for export. I wasn’t there as a tourist — I had been in the laser equipment business for years, and I was visiting to negotiate supply for an overseas client.

That day, I was struck by a fact that outsiders often find hard to believe: Chinese laser cleaning equipment sells globally for a fraction of what similar machines cost in Europe, the US, or Japan. And it’s not because they’re all low-quality knock-offs — far from it. Many of these machines are in use in aerospace plants, shipyards, and precision manufacturing lines worldwide.

So why are the prices so low? The answer is more complex than “cheap labor” or “government subsidies.” Let’s unpack it from the inside, based on both data and the conversations I’ve had over a decade of dealing with manufacturers, suppliers, and end-users.

1. The Real Search for Cost Efficiency

Before we get into the mechanics, let’s be clear about what makes people ask this question. Buyers — especially in Europe or North America — often see Chinese quotes that are 30–70% lower than local suppliers for what appears to be the same specification: same laser power, same cleaning width, same portability. Naturally, they wonder:

Is it cutting corners on quality?

Is there some hidden government support?

Are parts and labor really that much cheaper?

Or is there a different cost structure altogether?

As someone who’s purchased and resold hundreds of these machines into different markets, I can tell you: the answer is a mix of economics, supply chain structure, and market strategy.

2. Supply Chain Clustering: The “Shenzhen Effect” for Lasers

One of the most overlooked factors is industrial clustering. In China, you don’t have to order a laser source from one province, optics from another, casing from a third, and pay separate freight on each. In cities like Wuhan, Shenzhen, and Suzhou, entire ecosystems of suppliers exist within a 50–100 km radius.

When you need a beam delivery fiber, you walk two streets over. When you need a batch of precision galvanometer scanners, you call a neighbor in the same industrial park. This kind of geographic concentration slashes:

Transport costs for components

Lead times for production

Inventory storage costs

In contrast, European manufacturers often source from multiple countries, each with its own logistics, customs paperwork, and tariffs.

Table: Comparing Supply Chain Structures

| Aspect | Typical China-based Manufacturer | Typical Europe-based Manufacturer |

|---|---|---|

| Component sourcing radius | 50–100 km | 500–2,000 km |

| Lead time for parts | Days | Weeks |

| Logistics cost share | Low | Medium–High |

It’s easy to blame “cheap labor,” but this oversimplifies things. Yes, Chinese assembly line wages are lower than in Germany or the US — sometimes by a factor of 3–5. But in laser cleaning equipment, labor cost is not the dominant factor.

A 1,000-watt portable fiber laser cleaner might have a bill of materials (BOM) cost where the laser source alone accounts for 40–60% of the total cost. The casing, optics, and electronics take up most of the rest. Assembly labor is often less than 10% of the unit cost.

The real advantage comes from higher production volumes. When a factory produces thousands of units a year instead of hundreds, fixed costs like engineering, R&D amortization, and plant overhead are spread across more machines.

4. Government Support and Infrastructure

Now, government support is real — but it’s not as simple as “they get free money.” Instead, Chinese manufacturers benefit from:

Export tax rebates on certain categories of laser equipment

Lower-interest loans for high-tech manufacturing expansion

Industrial parks with subsidized utilities

Also, infrastructure readiness plays a huge role. A manufacturer in Wuhan can get a new production line hooked to stable power and fiber-optic internet in days. In some countries, similar upgrades can take months of approvals and extra costs.

5. Domestic Competition Is Fierce — and That Pushes Prices Down

The Chinese domestic market is cut-throat competitive. Dozens of mid-to-large-scale companies fight for market share, often selling at slim profit margins to secure contracts. This price pressure doesn’t just affect domestic buyers — it ripples into export pricing.

I’ve seen cases where two Chinese suppliers undercut each other so aggressively for a European buyer that the final price was lower than the domestic retail price. They’d rather take a small loss on a high-profile export project for the marketing value.

6. Component Localization and Cost Control

Over the last 10 years, Chinese manufacturers have localized many components that used to be imported. Ten years ago, high-end fiber laser sources came almost exclusively from IPG Photonics (USA/Germany). Now, domestic companies like Raycus, Max, and JPT dominate much of the local supply, offering performance that’s competitive for cleaning applications at a fraction of the import price.

Other components — beam expanders, scanners, cooling systems — have also shifted to local suppliers. This localization removes not just import duties but also currency fluctuation risks.

7. Scale and Specialization in Manufacturing

When a single factory runs dedicated assembly lines for 500-watt, 1,000-watt, and 2,000-watt cleaning systems, the efficiency gain is significant. Workers repeat the same processes, tooling is optimized, and testing rigs are standardized.

I’ve walked into European facilities where a single team builds both custom laser welding systems and cleaning units — great for flexibility, but it can’t match the cost efficiency of a factory producing thousands of identical cleaning machines monthly.

8. Strategic Pricing for Market Entry

Another truth: price is a weapon. Many Chinese manufacturers deliberately keep export prices low to break into new markets. Once they establish dealer networks and after-sales support, they may gradually raise prices — but the initial penetration strategy is aggressive.

In Southeast Asia and parts of Eastern Europe, I’ve seen Chinese suppliers sell laser cleaning systems at near-BOM cost just to edge out local distributors.

9. Quality Ranges Vary — and That Matters

It’s important to note: not all low-cost Chinese laser cleaners are equal. The price you see online might reflect:

A lower duty cycle rating

Less robust cooling system

No international certification (CE, FDA, etc.)

Shorter warranty and weaker after-sales support

For industrial buyers, the challenge is finding the right balance — a reputable Chinese manufacturer offering solid quality at a lower price, rather than simply the cheapest unit on Alibaba.

10. My Direct Experience with Clients

Over the years, I’ve helped clients in shipbuilding, automotive restoration, and heritage conservation source laser cleaning equipment from China. In many cases, the total landed cost (machine + freight + duties) was still less than 50% of a European equivalent.

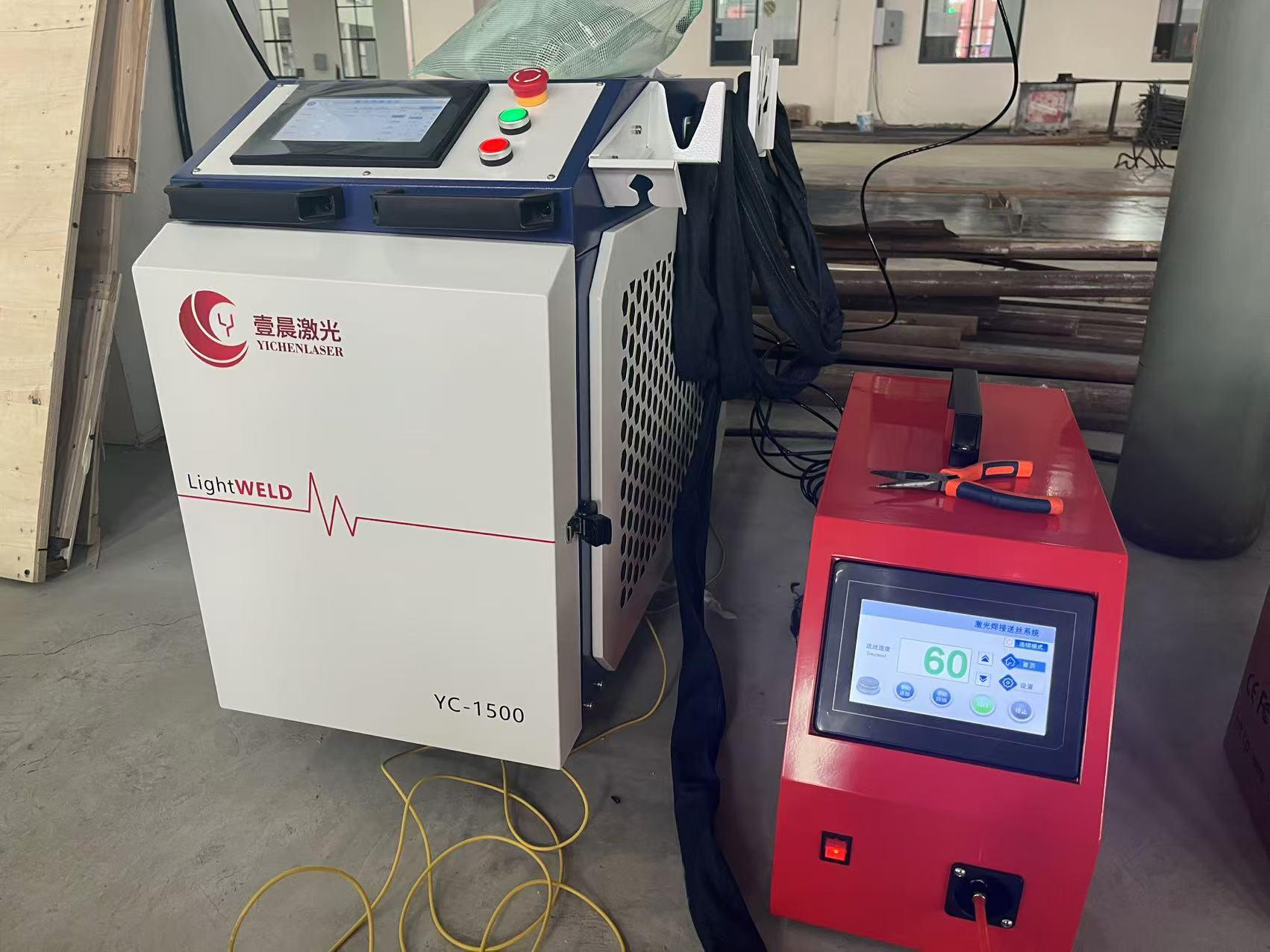

One UK heritage restoration firm told me their Chinese-sourced 1,500-watt cleaner paid for itself in just four months — even factoring in an eventual upgrade to a better cooling unit.

11. Future Trends — Will Prices Stay This Low?

I suspect prices will gradually rise as:

Labor costs in China increase

More companies pursue high-end branding

International certification becomes standard for export

However, the underlying cost advantages — supply chain clustering, localized components, scale — will keep Chinese machines competitive for years.

Conclusion

The reason Chinese laser cleaning machines are the cheapest in the world isn’t just one factor — it’s a combination of industrial clustering, localized component supply, fierce domestic competition, scale efficiency, and strategic pricing. Quality varies, but for many applications, the best Chinese systems offer world-class performance at an unbeatable cost.

From the factory floors I’ve visited to the client projects I’ve supported, the pattern is clear: China has turned laser cleaning from a niche, high-cost technology into a mass-market, accessible tool.

Q&A Section

Q: Are Chinese laser cleaning machines lower quality than European ones?

A: Not necessarily. Some are on par with European machines, but there’s a wide range. Quality depends on the manufacturer, not just the country of origin.

Q: How much cheaper can they be?

A: Depending on power level and specs, 30–70% cheaper than equivalent European or US models.

Q: Do they meet CE or FDA safety certifications?

A: Many do, especially those targeting export markets, but always verify certification documents.

Q: What’s the biggest hidden cost?

A: After-sales support. Ensure the supplier or dealer can provide spare parts and service within your region.

Q: Will Chinese prices rise in the future?

A: Gradually, yes — but cost advantages from supply chain and scale will remain significant.